Foundation Damage Coverage Checker

Coverage Result

✓ Sudden & accidental damage from named perils is typically covered

✗ Gradual settlement, soil movement, and wear & tear are usually excluded

✓ Water-related perils may be covered if the source is sudden

✗ Standard policies generally don't cover foundation issues from natural settling

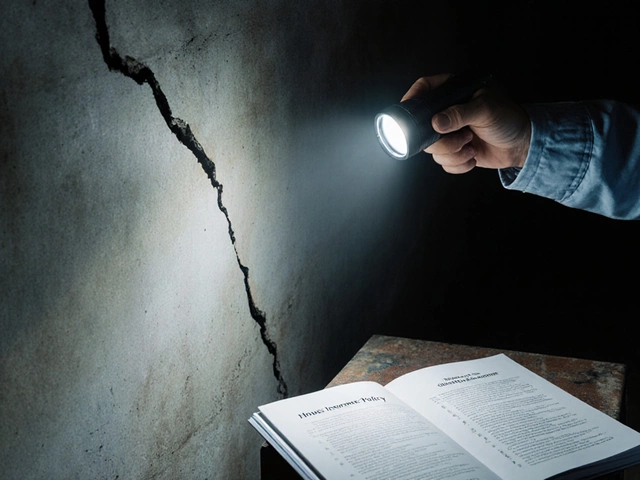

When a crack shows up in the basement wall or an uneven floor shakes you awake, the first thought is usually "who’s paying for this?" The reality is that house insurance can be a lifesaver, but it’s not a blanket fix. This article breaks down exactly when a standard policy steps in, where it draws the line, and how you can shore up gaps before a foundation problem knocks on your door.

Key Takeaways

- Standard dwelling coverage typically covers sudden, accidental damage, not slow‑moving foundation problems.

- Water‑related perils (burst pipes, storm surge) may trigger coverage if the source is sudden.

- Endorsements and separate foundation warranties can fill the coverage void.

- Documenting the issue and acting quickly improves claim success.

- Understanding policy language prevents costly surprise denials.

What Does a Typical House Insurance Policy Cover?

House insurance is a type of property insurance that protects homeowners against financial loss from covered perils. It usually includes dwelling coverage, personal property protection, liability limits, and additional living expenses. The core of the policy-dwelling coverage-pays for the physical structure of the home, but only for damage caused by listed perils, not wear‑and‑tear.

Policies are built around two concepts: perils (the events that cause damage) and exclusions (the events or conditions the insurer refuses to pay for). Knowing the difference is crucial when a foundation issue arises.

Foundation Issues: The Good, the Bad, and the Excluded

Foundation issues are problems that affect the stability of a home’s base, such as cracks, settlement, bowing walls, or uneven floors. Not all foundation problems are created equal in the eyes of an insurer.

Covered scenarios usually involve sudden, accidental events that directly impact the foundation:

- A burst water pipe at the foundation wall causing immediate flooding and wall displacement.

- Heavy rain leading to a rapid rise in groundwater that forces a wall to buckle.

- Impact from a vehicle or construction equipment that hits the foundation.

Exclusions dominate the rest of the list:

- Gradual soil movement or settlement over years.

- Cracks from dry‑out and shrinkage of clay soils.

- Damage caused by pests, such as termites weakening support.

- Normal wear‑and‑tear, including minor hairline cracks.

Because most foundation failures stem from slow, progressive forces, insurers frequently rely on the exclusion clause to deny claims.

How Perils Influence Coverage

The term perils

perils refers to specific causes of loss listed in a policy. Two common frameworks exist:

- Named‑peril policies - only losses from perils explicitly listed (e.g., fire, windstorm, hail) are covered.

- All‑risk (or open‑peril) policies - cover any loss unless it’s specifically excluded.

Even an all‑risk policy won’t pay for a foundation issue that’s labeled as an “excluded cause.” For a claim to succeed, the damage must be traced to a covered peril that was sudden and accidental. For example, a sudden pipe burst that floods the crawlspace will likely be covered, but a slow‑acting sinkhole will not.

Steps to File a Foundation Damage Claim

When a foundation problem bites, following a clear process can make the difference between a paid claim and a denial:

- Secure the property. Stop further damage by turning off water, placing sandbags, or calling a professional to stabilize the area.

- Document everything. Take high‑resolution photos, videos, and notes on the date, weather, and any recent events (e.g., a heavy storm). Keep receipts for emergency repairs.

- Notify your insurer promptly. Most policies require notification within a specific window (often 30 days). Use the insurer’s preferred method-online portal, phone, or email.

- Insurance adjuster visit. The adjuster will inspect the damage, ask for documentation, and may request a structural engineer’s report.

- Obtain professional reports. A licensed structural engineer can pinpoint the cause and determine if it was sudden.

- Submit the claim. Include photos, engineer’s report, repair estimates, and any emergency expenses.

- Negotiate if needed. If the insurer offers a lower payout, you can provide additional evidence or seek an independent appraisal.

Patience and thoroughness pay off. Adjusters often look for signs of pre‑existing damage; the more you can prove the issue was sudden, the stronger your case.

Boosting Coverage: Endorsements, Riders, and Separate Policies

Because standard policies leave most foundation woes uncovered, homeowners can add supplemental protection:

| Option | What It Covers | Typical Cost Add‑On | Pros | Cons |

|---|---|---|---|---|

| Standard Dwelling Coverage | Sudden, accidental damage from named perils | Included in base premium | No extra cost; already part of policy | Excludes most foundation settlement |

| Foundation Repair Endorsement | Specific coverage for foundation settlement caused by sudden events (e.g., pipe burst, flood) | +0.5-1% of dwelling premium | Fills key gaps without a separate policy | May still exclude slow‑moving soil issues |

| Separate Foundation Warranty | Comprehensive repair or replacement for structural foundation defects, regardless of cause | $500-$2,000 annually | Broad protection, often includes engineer fees | Higher ongoing cost; separate contract |

| Flood Insurance (NFIP) | Water damage from rising water, storm surge, or flood | Varies by risk zone, typically $300-$1,200/year | Essential in flood‑prone areas | Does not cover structural cracks unrelated to water |

Adding a foundation endorsement is often the most cost‑effective step. However, if you own an older home on expansive clay or a property with known soil challenges, a dedicated warranty may be worth the extra premium.

Common Pitfalls and How to Avoid Them

Even with the right coverage, mistakes can lead to a denied claim. Here are the most frequent slip‑ups:

- Waiting too long. Insurance contracts usually require “prompt” notification. Delays can be interpreted as negligence.

- Skipping professional evaluation. Relying on a DIY assessment rarely satisfies an adjuster. A licensed engineer’s report carries weight.

- Failing to read exclusions. Many policies have a “gradual settlement” clause. Knowing it up front saves frustration.

- Using unapproved contractors. Some insurers require work to be performed by licensed, insured tradespeople; otherwise, they may cap reimbursement.

- Not keeping receipts. Every repair invoice, rental expense, or temporary fix should be saved for the claim file.

By staying proactive-regularly inspecting your foundation, maintaining proper drainage, and reviewing policy language each renewal-you reduce both the likelihood of damage and the chance of a claim denial.

When to Call a Professional Before Filing

Before you even pick up the phone, consider these triggers that merit a structural engineer’s involvement:

- Visible cracks wider than ¼ inch in a load‑bearing wall.

- Doors or windows that suddenly stick or won’t close.

- Uneven floors that can be measured with a level or straight edge.

- Water stains that appear after a heavy rain but weren’t there before.

- Any sudden movement noticed after an earthquake or major storm.

A qualified engineer will not only pinpoint the cause but also produce a written report that directly ties the damage to a covered peril-critical evidence for a successful claim.

Frequently Asked Questions

Does standard home insurance ever cover foundation cracks?

Only if the crack results from a sudden, accidental covered peril-like a burst pipe or a storm‑driven flood. Gradual settlement or soil movement is usually excluded.

What’s the difference between a foundation endorsement and a foundation warranty?

An endorsement adds specific coverage to your existing policy, typically for sudden events affecting the foundation. A warranty is a separate contract that covers a broader range of defects, even those that develop slowly.

How quickly must I report foundation damage?

Most policies require notification within 30 days of discovering the damage. Check your own policy wording, but acting sooner is always safer.

Can flood insurance replace a foundation endorsement?

Flood insurance pays for water damage caused by rising water or storm surge, but it doesn’t cover structural cracks that aren’t directly water‑related. You may still need a foundation endorsement for other sudden events.

What documents should I keep for a foundation claim?

Photographs, video walkthroughs, engineer’s reports, repair estimates, receipts for emergency measures, and any correspondence with the insurer.

Write a comment