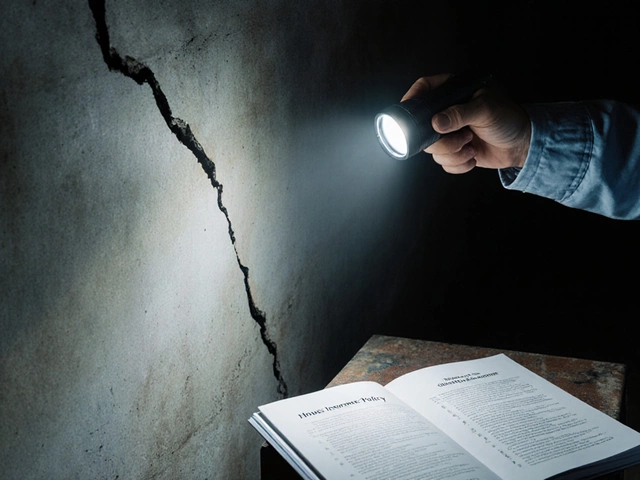

Cracks spreading across your living room wall, sagging floors, a shifting foundation—these aren’t just annoying home problems. For most people, they spell out thousands in repairs and one burning question: Is this covered by insurance? You fork out cash every year for a homeowner’s policy, but when it comes time to file a claim, the rules can feel like a maze. Insurance companies have carved out more loopholes than a slice of Swiss cheese, and it can get pretty confusing fast. This is the reality for millions of homeowners across the country. The real kicker? Most folks don’t find out what their policy does and doesn’t cover until disaster strikes.

What Types of Structural Damage Does Insurance Usually Cover?

Let’s get straight to it: insurance is picky. Most standard homeowners insurance policies cover “perils,” which are unexpected events like fire, windstorms, and certain sudden water damage. If your foundation cracks out of nowhere because of an earthquake, you’re basically out of luck unless you paid for a specialty policy. With regular homeowners policies—referred to as HO-3 by most agents—insurance wants to see that the structural damage was caused by something out of your control, something unexpected, like a tree crashing through your roof during a storm. If your house starts to sink because the soil underneath is expanding or shifting? That’s almost always a denied claim unless you have a rare (and expensive) earth movement or flood add-on.

Insurance companies call this the “named perils” approach. For example, say your foundation cracks after a plumbing pipe bursts under your home. If your policy covers sudden, accidental water damage, you might get lucky. However, if the crack has been forming for months, and it turns out the pipe’s been leaking all along, insurance investigators will probably say it’s "gradual wear" and hand you a denial letter. For fires, windstorms, and accidentally fallen trees, you’re usually in the clear. But issues like rot, old age, pests, or normal settling? Standard policies slam the door on those claims. Here’s something wild: according to the Insurance Information Institute’s 2024 survey, water-related claims are the single largest source of loss, accounting for more than 30% of all structural damage claims filed. Yet, less than half get approved—mainly because adjusters blame "maintenance neglect."

Check out what’s usually covered versus denied:

| Cause of Damage | Usually Covered? | Notes |

|---|---|---|

| Fire | Yes | Standard in almost every policy |

| Windstorm/Tornado | Yes | May have high deductibles in storm-prone areas |

| Fallen Tree (during storm) | Yes | Must hit the insured structure |

| Plumbing Leak (sudden) | Maybe | Depends on cause and duration |

| Foundation Settling (age/soil) | No | Usually viewed as maintenance |

| Termite Damage | No | Seen as preventable |

| Earthquake | No | Requires special endorsement |

| Flood | No | Separate flood policy needed |

This table spells it out: if the damage is fast and unexpected, you stand a chance. If the problem brewed quietly or could have been prevented, insurance companies slam the brakes. The grayest area is always “water damage,” so pay extra attention to the fine print about leaks and sewer backups.

Why Insurers Deny So Many Structural Damage Claims

You’d think that anything causing major harm to your home would get an easy yes from your insurer. But that’s rarely how it works. In 2023, over 44% of all structural or foundation claims were denied by the top five national providers. Why all the pushback?

The main reason: insurers expect you to perform regular home maintenance. If you miss signs of a tiny foundation crack that gets huge over years, they call it “gradual deterioration” and put it on your tab. Got some mold growing after an old leak? They put it under "owner neglect." Shifting ground due to drought or heavy rain? That’s just “earth movement”—another exclusion. Companies argue that if they paid for every settling foundation or leaking pipe, premiums would skyrocket for everyone. It’s harsh, but insurers are in the business of risk, not charity. In fact, in Texas, a study from the Foundation Performance Association found that only 2% of home foundation issues were covered by standard insurance policies without any add-ons.

Another gotcha: insurance adjusters are trained to dig for justifications to deny claims. They’ll look for signs of prior issues, missed repairs, or long-term wear. A whole industry of forensics has popped up to connect the dots between damage and neglect versus sudden disaster. Did your gutter overflow for six months? Evidence of long-term water exposure can tank your claim. If you’re dealing with a denial, experts suggest getting your own structural engineer to back you up. Their reports often have more weight if you end up fighting the refusal.

Here’s where it gets really frustrating: suppose your house takes on water in a flood, damaging the foundation. You hop on the phone expecting your regular policy to have your back. But unless you’ve got flood insurance through the National Flood Insurance Program or a rare private policy, you’re on your own for repairs. The same story with earthquakes or mudslides in California—no coverage unless you bought a separate protection plan, which less than 15% of homeowners do.

If you’re ever unsure, call your agent and ask for a real answer in writing. Policies are full of endless legal speak, so don’t settle for vague promises over the phone. And if things go south, don’t take the first denial as final. Appeal with documentation or outside expert assessments.

How to Boost Your Odds of Getting Structural Damage Covered

So you’ve found a crack, or worse, a wall starting to shift. What now? First step: document everything. Take pictures or videos the moment you notice the issue. If water is bubbling up or a tree just smashed your garage, make a record right away—timestamps matter when claims get reviewed.

If it was a sudden event, like a storm, get receipts or proof from local news about weather at the time—insurance adjusters actually use this stuff. For water leaks, hire a plumber to confirm when it started. Their statement can be the difference between a “sudden” event and “long-term neglect.” In 2024, some big insurers started using smart home devices, like water leak detectors and sensors, as ‘trusted sources’ to help settle disputes. It can literally pay to have that tech installed.

Tips from experts (and claims adjusters themselves):

- Always file a claim as soon as possible. Delays are suspicious to insurance companies.

- Perform regular home maintenance and save records. Keep a log of service visits, repairs, and inspections—even photos if you notice small cracks over time.

- Ask for a full copy of your policy each year (in writing) and highlight what’s covered for “dwelling protection” or “dwelling extension.”

- If you live in high-risk areas, like flood zones or earthquake-prone counties, invest in extra protection. Some new home mortgage lenders now make this mandatory.

- Get an independent inspection before you buy a house. Hidden cracks or settling can show up a few years later, and the previous owner’s insurance won’t help you after closing.

- If your claim gets denied for “maintenance neglect,” bring in a licensed structural engineer to write up your side of the story.

Spotting a few hairline cracks and worried? Not every crack means disaster. According to a 2023 study from The American Concrete Institute, only about 8% of all residential cracks signal significant foundation movement. Still, routine maintenance and vigilance can save you from surprise expenses—and help you prove your side to the insurance company if the worst happens. Want to see how often certain types of claims are approved? Look below.

| Type of Claim | Approval Rate (2024) |

|---|---|

| Wind/Storm Damage | 76% |

| Fire | 89% |

| Water Leak (sudden) | 51% |

| Foundation Settling (age/soil) | 9% |

| Termite Damage | 2% |

| Earthquake | 22%* |

| Flood | 13%* |

*Only for homes with specialty endorsements

It’s clear: you can’t assume you’re protected just because you pay for insurance. To boost your odds, read your policy cover to cover. Take regular photos. Don’t skip the boring maintenance stuff. And if you find trouble, don’t panic—there’s always an appeal path or a way to get a second opinion. Insurers do expect you to ask questions and fight for your coverage, so don’t be shy about pushing for what you deserve. The world of structural damage coverage isn’t built for easy answers, but a little know-how and grit can keep your home's future rock solid.

Write a comment